MERICS Top China Risks 2025

Trump, de-risking, trade disputes: 2025 will be a year of adjustments

For Europe, 2025 will be a year of adjustments. Donald Trump’s return to the White House will alter US foreign policy. He has pledged to compete on tougher terms with China through tighter restrictions on trade and technology that will hit Europe too. Beijing is most likely to respond by taking a more hardline approach to any attempts at de-risking. As a result, Europe could find itself squeezed by simultaneous trade disputes with its two largest economic partners, while dealing with Russia’s full-scale invasion of Ukraine.

To help European actors anticipate what 2025 might bring, MERICS has developed a foresight effort to identify key China risks. We sought to pinpoint risks with the biggest impact on European interests and security. We identified them by hosting two separate, off-the-record foresight workshops with officials and experts from across Europe. They assessed how the US elections would impact Europe-China relations and the EU’s China policy. We then held a further, internal workshop with analysts from all of MERICS research teams to refine our selection of risks.

MERICS Top China Risks 2025 consists of the most probable and highest impact risks we identified, the ones that have urgent implications for European policymakers and businesses. We will track them throughout the year in upcoming issues of the MERICS China Security and Risk Tracker.

Nor will we lose sight of the risks our expert groups thought less impactful or less likely to materialize in 2025. Many harbor the potential for major implications in Europe. Among such risks, we include the challenges to social cohesion in China, the possibility of conflict in the South China Sea, or the collapse of international cooperation on climate or other global issues.

In 2025, European actors should brace themselves for greater risk and uncertainty in relations with both China and the United States. The new Trump administration will set in motion global geopolitical and geoeconomic changes. European actors will have to find ways to navigate them without losing sight of Europe’s key interests and objectives.

Top China risks 2025

The United States’ new China (and Europe) policies: Trump’s return, and Beijing’s response, will challenge Europe’s unity and de-risking agenda

The biggest risk for Europe’s China policy next year lies in the geopolitical adjustments after president-elect Donald Trump returns to the White House in January. The new administration’s top foreign policy appointees may hold different views of the US role in the world, but they share a view of China as the main threat to US interests. The Trump administration will take a hard line on trade and tech relations with China from the start, whether as a push to bring Beijing to the negotiation table, or as a way to limit China’s global influence.

Either way, we can expect a rapid deterioration in already-strained US-China ties. Similar dynamics could play out in the transatlantic relationship if Washington decides to use tariffs to target its trade deficit with the EU. Transatlantic tensions would also grow if Washington decided to reduce US support for Ukraine and NATO in order refocus US efforts on the Indo-Pacific.

In this scenario, Europe would find itself between a rock and a hard place, which could undermine its cohesion and de-risking agenda. The EU will face increased pressure to align with US approaches towards economic and tech decoupling from China. It may also have to find ways to step up support for Ukraine without relying on the United States.

Meanwhile, Beijing will continue to try to derail the EU’s de-risking strategy. It will pressure member states using investments in Europe, the threat of tariffs and threats and promises over market access within China. China will also leverage transatlantic tensions, and the potential EU-US trade conflict, to reapproach Europe offering to improve relations. While China’s offer will not be very substantial, it is likely to find a receptive audience in some member states and in some corners of the corporate sector likely to be reeling from Washington’s pressure or their loss of access to the US market. Brussels’ de-risking strategy and overall China policy risks becoming paralyzed if member states start hedging between the United States and China. Europe will need a clear strategy to protect its own interests independently and to avoid becoming an arena of US-China competition.

China’s economy is in a period of transition as its economic model falters and consumption fails to pick up. Despite the economic downturn, Beijing is consciously funneling resources into industrial policy and supply-side measures. This is in line with President Xi Jinping’s goal of developing “new quality productive forces” to deliver breakthroughs in technology, industrial transformation, and the allocation of factors of production. China accounts for slightly more than 30 percent of global manufacturing but slightly less than 20 percent of global GDP. Its continuous investment in production will worsen that imbalance. China’s overcapacities are already well documented in the car and steel industries; they are also emerging in other sectors, like semiconductors or electrolyzers.

Given the anemic growth of domestic demand, Beijing will continue to rely on exports to solve its overcapacity problem. If the incoming Trump administration implements his threatened 60 percent tariffs on imports of Chinese goods, China’s cheap export goods will flow into the EU (and other third markets) at even greater rates during 2025.

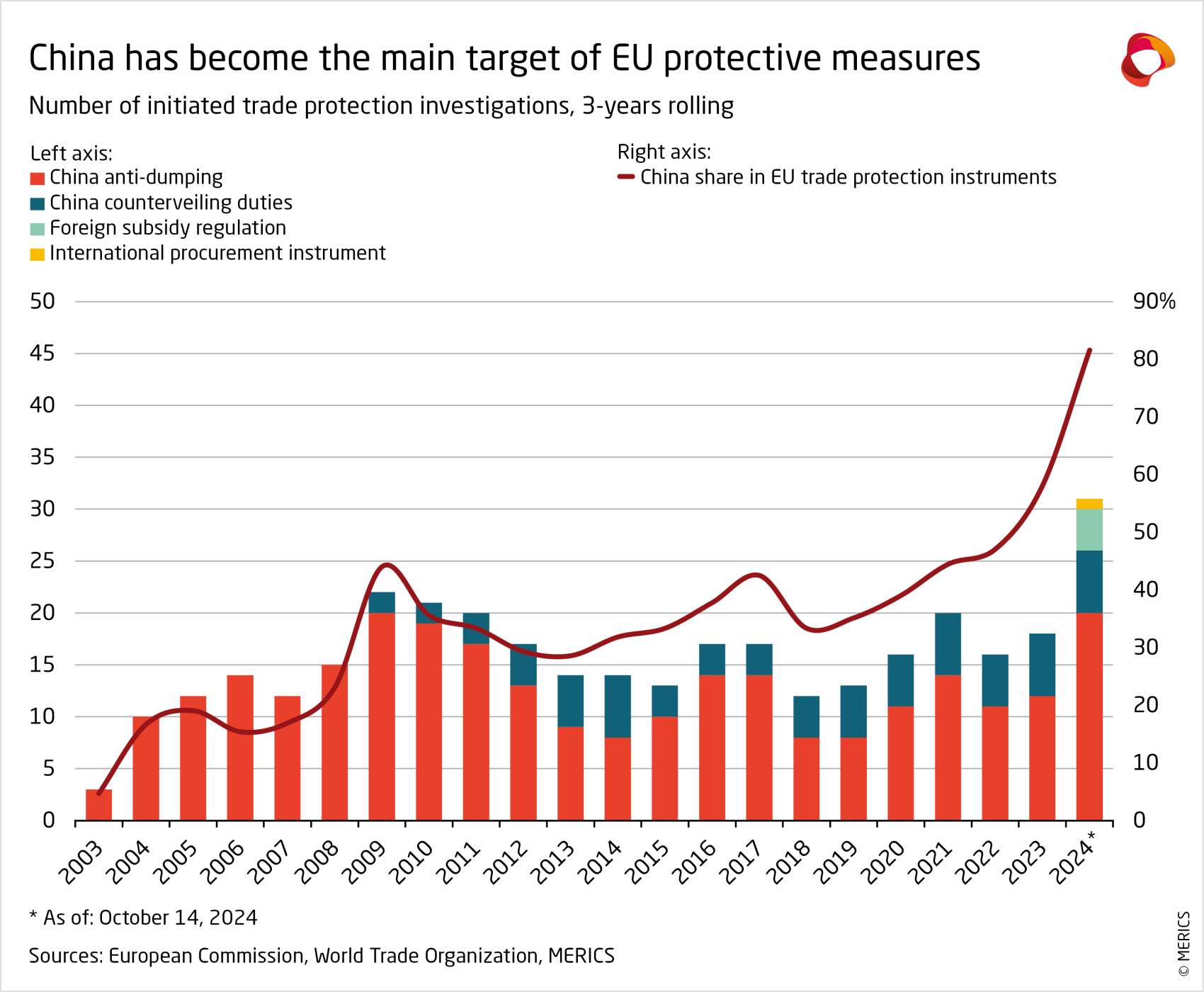

The new European Commission has signaled that the next five years will see further anti-subsidy investigations and trade actions to support the EU’s competitiveness and geopolitical standing. This strategy has some chance of success. Beijing’s relatively restrained reaction to the EU tariffs on Chinese EVs suggests it still sees maintaining access to the EU market as the key to the survival of its export-led growth model. However, the EU’s success will depend on how far it can maintain unity and member state buy-in to use its toolbox against Chinese distortions. It will need to maintain unity in the face of potential Chinese retaliation and likely amid a simultaneous trade conflict across the Atlantic.

Tech entanglements and national security: Research and tech collaboration with Chinese partners will become riskier

Alongside Xi’s ever-greater securitization of science, technology and the economy, there is growing evidence of a shift in Beijing away from the military-civil fusion strategy to a bolder and more far-reaching goal of developing an “integrated national strategic system” (一体化国家战略体系). Under this new system, the civilian, military and national security sectors will operate in sync in support of Beijing’s strategic objectives. This would accelerate the upgrading of China’s strategic capabilities and support the modernization of the People’s Liberation Army (PLA). First proposed in 2017, this concept received scant attention until 2023. Since then, it has gradually become one of the centerpieces of Xi’s pitch to the military and national security sectors. As competition with the United States worsens, this program is likely to get greater priority in 2025.

There are strong implications for Europe in China’s growing mobilization of its entire economic and innovation systems and their planned integration into military R&D and weapons production. The risk of European companies, academic institutions and other research centers accidentally contributing to China’s military modernization will grow in 2025, and beyond. European entities could well be providing China with an advantage in critical dual-use sectors without their knowledge or consent.

Crucially, European technology might not only help strengthen the PLA, but also flow into Russia, leading to a stronger Russian challenge in the European theater. Against this backdrop, transfers of dual-use European technology to China will take on a whole new meaning. Research collaboration with Chinese partners will require increasingly complicated and costly due diligence processes. To deal with these new dynamics, Europe will need new paradigms to manage research and tech entanglements with China.

China-Russia cooperation: Beijing’s support for Moscow and North Korea’s direct involvement in Ukraine will worsen the challenges Europe faces from Russia

China-Russia relations continue to deepen as we approach the fourth anniversary of Moscow’s full-scale invasion of Ukraine. The EU’s announcement of “conclusive evidence” that armed drones are being produced in Xinjiang for Russian use confirms that China’s fundamental calculus remains unchanged. Beijing views backing President Vladimir Putin as the best way to defend its strategic objectives and prevent the United States from turning its focus fully on China. This strategic calculus means Beijing is unlikely to change course on its partnership with Moscow in 2025.

However, the dynamics between the two partners are getting more complicated. North Korea has entered the fray, deploying over 10,000 soldiers to fight Ukraine and delivering weapons and ammunition to prop up Moscow’s war effort. In exchange, Russia is not only giving Pyongyang much-needed food and energy (over one million barrels of oil delivered between March and November 2024), but also military technology and hence an alternative to China.

Beijing is unlikely to welcome the potential impact on Kim Jong-un’s appetite for risk; the reduction in North Korea’s dependence on China; or global perceptions of linkages between the European and Indo-Pacific theaters. But, for now, China seems to be tacitly greenlighting this relationship as a way to prop up Russia and weaken Ukraine and the West.

Though a fully-fledged axis does not yet exist, the (bilateral) relations between the three partners will further solidify in 2025, multiplying the impact of Russia’s challenge to European security. There is little to no room for Europe, or Washington, to split up these partnerships or pressure Beijing to constrain cooperation between Russia and North Korea so long as all three countries believe their cooperation supports their strategic objectives. Beijing, in particular, seems to have concluded the West’s approach to China is unrelated to its stance on Ukraine and will see little incentive to change positions towards Russia or inject itself into the budding Moscow-Pyongyang relationship. Europe should therefore look instead into increasing China’s costs for this cooperation.

China’s business environment: Push to build a “fortress economy” will increase risks for European firms

China’s leadership will likely see Donald Trump’s return to the White House as justifying President Xi’s agenda over the years, and double down on key measures fostering securitization and self-reliance. In 2025, the world may see China become more intransigent, heavy-handed and focused on developing defensive measures designed to shield the Chinese economy from external action. Beijing may become more willing to deploy the offensive instruments it has developed. It is more likely to hit back if it perceives US sanctions or other measures being used solely as instruments to contain China’s rise, rather than as a means to get to a deal.

For European companies, the push to build a “fortress China” will worsen the business environment still further. The push for localization and self-reliance will limit their access to the Chinese market. National security and patriotic education campaigns will continue to stoke the general suspicion of foreigners. And recent legislation, including the Anti-espionage Law, State Secrets Law, Personal Information Protection Law and National Security Law, among others, will hinder their efforts to conduct due diligence.

Companies will find themselves unable to access the information they need and personnel could even be risking detention for espionage for seeking normal, commercial information. Cases have already emerged. US due diligence firm Mintz Group was fined USD 1.5 million between 2023 and 2024, and some of its staff were detained for due diligence work in China, accused of conducting “unapproved statistical work.”

Europe’s many new supply chain security and forced labor laws and regulations mean that European firms will face increasingly difficult choices over their operations in China – one example of these forthcoming laws is the EU’s Corporate Sustainability Due Diligence Directive, which came into force in July 2024 and will be transposed into the national legislation of member states over the next two years.